How is EMI Calculated for a Personal Loan?

Taking a loan is an important financial decision in a person’s life, and as someone who has gone through that loan period, I understand how significant it is to fully understand the concept of EMIs. So, let’s discuss and learn how is EMI calculated for personal loan.

My journey with personal loans taught me the importance of understanding how monthly payments work to avoid financial stress and maintain physical and mental peace. Let me share my perspective and experience to help you gain detailed information about how EMI and personal loans work and prepare you before making any decisions.

EMI

EMI is the specific or fixed money paid monthly for a certain period of time by a borrower to the lender. This is because while the principal amount repaid increases in each subsequent payment, the interest portion that is paid reduces. However, it has to be paid. Instead of calculating it on your own and spending some time to do so, one can avoid any mistakes and use an EMI calculator. However, all these must have been stated including the loan amount, interest rate as well as the term been specified therein.

When I took my very first loan, I realized how EMIs helped me plan my budget monthly. The breakdown of principal and interest kept changing overtime but the never-changing payment amount made it easier for me to manage my financial and social without any problems.

EMI Calculation

Before applying for my loan, the first thing that came to my mind was to consider my budget and all the expenses that i have and are going to add up in near future. So, i begun to calculate my EMI to assure it fit my budget and wont go out of my limit. Basically, EMI depends on three main factors, they are:

- The Loan Amount i.e Principal

- The interest rate

- The loan Tenure

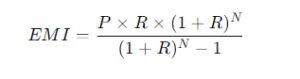

The formula used to calculate EMIs:

Where,

- P= Loan Amount (Principal)

- R= Monthly intrest Rate (Annual Rate Divided by 12)

- N= Loan tenure in months.

For Example:

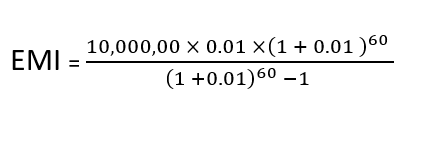

I took NPR 10,000,00 at an annual interest rate of 12% over a period of 5 years, this is how I calculated my EMI:

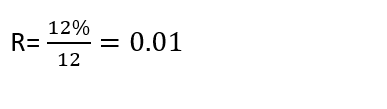

- Convert the annual interest rate to a monthly rate:

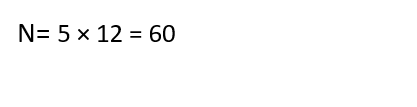

- Calculate the total number of months:

3. Put the values into the formula:

So, by using this process and formula my EMI was approximately NPR 22,244.45. Realizing the amount made me feel the money I should pay monthly is quite manageable based on my monthly income, but taking interest into account made me realize how important it is to select the right loan terms.

Key Insights

1. Knowing Principal and Interest:

It was surprising at first that the majority of EMI payments were used to pay the interest. A greater percentage of payment began to go toward principal payments as the amount of principal owed dropped over time. This change was the result of most lenders using the lowering balance strategy.

2. Time Impact on EMI:

EMI increased dramatically when I thought about a shorter tenure, yet the total interest outflow decreased. However, a longer tenure significantly raised the total amount of interest I paid, but it also made the EMI more affordable. I chose a compromise that struck a balance between expense and affordability.

3. Importance of Down Payment

I prepaid a portion of my loan with every bonus or additional money I earned. By lowering my outstanding principal, I was able to save money on interest and subsequent EMIs. Before using this tactic, I highly advise you to inquire about prepayment fees with your lender.

Common Mistakes To Avoid

- Over-loaning

- Snubbing Interest Rates:

- Ignoring Loan Terms

- Rushing the Decision

- Not Considering Downpayment

- No research on suitable deals

- Believing in Rumours.

We now know about planning and financial discipline from taking out a personal loan. At first, EMIs may seem overwhelming, but they can be managed with the right knowledge and preparation. Anyone thinking about taking out a loan should take the time to study their alternatives, comprehend the effects of interest rates and duration, and make use of resources such as EMI calculators.

Even more emphasis on making loan payments on time and obtaining better terms could be clinical for loans. When it comes to debt management, even the smallest effort counts. Recall that while taking out a loan entails responsibility, it can also present an opportunity to reach your financial objectives stress-free if handled properly.