Making smart decisions is essential to operating a successful company, and management accounting is like a guide that assists you in doing just that. It offers the methods and resources required to comprehend your financial situation, make plans, and maintain the direction of your company.

If you’ve taken a Management Course, you’ll likely know how crucial these tools can be. Management accounting provides the data you need to make wise decisions, whether creating a budget, figuring out expenses, or planning for various eventualities.

In this blog, we’ll review some of the most essential tools and methods in management accounting. We’ll look at key principles that anyone exploring What is Management Accounting should know and demonstrate how these practices can improve decision-making and help you steer your company towards success.

Budgeting Tool

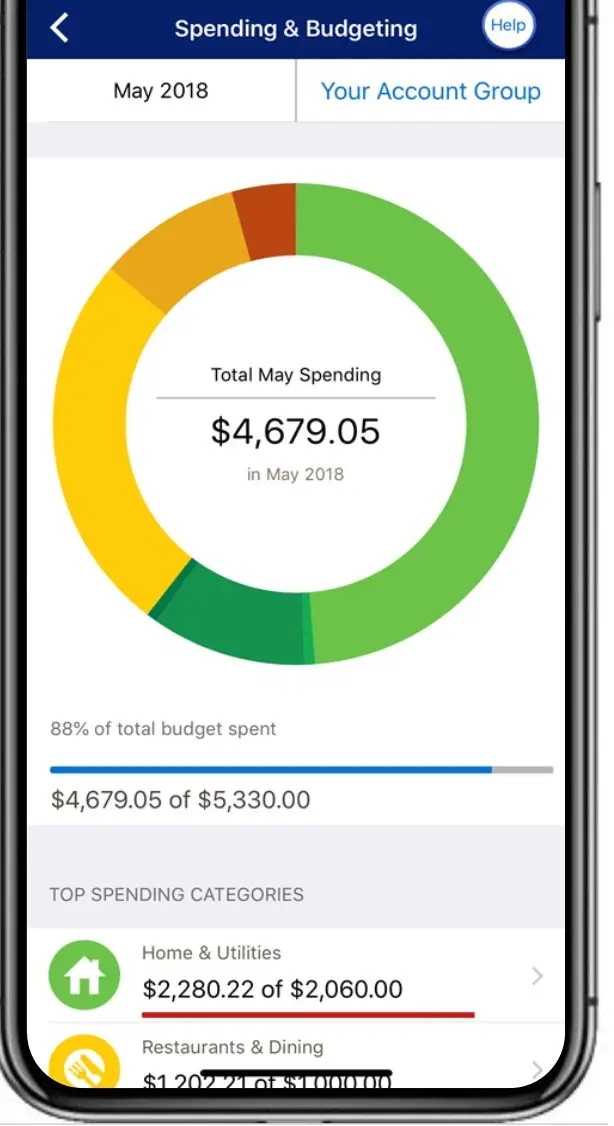

One of the core tools of management accounting is budgeting. It entails putting together a financial plan that projects earnings, costs, and revenues for a given time frame, usually a fiscal year.

Budgets act as the organisation’s road map, assisting management in setting financial objectives and allocating resources effectively.

The budgeting process includes several steps:

Setting Objectives: Management starts by outlining the organisation’s long term financial and operational objectives.

Estimating Revenues: Management projects the company’s revenue based on market research and past data.

Estimating Expenses: Cost estimation is based on anticipated changes in the business environment and historical expenses.

Finalising the Budget: Senior management completes and approves the budget after creating all estimates.

Budgets are essential for performance evaluation because they offer a standard by which real financial performance can be evaluated. By comparing actual outcomes with the budget, management can find variations, comprehend their reasons, and take corrective action to ensure the company stays on course to meet its objectives.

Read More: Updated UP Grading System – University of the Philippines

Forecasting Tool

Another key tool in management accounting is forecasting, which projects future financial results using past data and market and economic factors. While forecasting is a dynamic process updated regularly as new information becomes available, budgeting offers a static financial plan.

By using forecasting management may better predict changes in the business environment and modify their plans as necessary. For example, management can take preventive steps like cutting expenses or diversifying its product offers to lessen the impact if a company expects a fall in sales owing to an economic downturn.

Forecasts are usually for financial indicators, including earnings, cash flows, expenses, and sales. Using these projections with budgets, management may make well-informed judgements about resource allocation, investment opportunities, and risk management.

Variance Analysis Tool

This tool assesses the actual values against the expected ones, the budgets. The deviation planned from the actual outcome is referred to as the variance, and this variance can be either variance gain or variance loss. They include the following: the favourable variances are occasions whereby performance surpasses expectations, while the unfavourable variances illustrate the cases whereby performance does not meet expectations.

It informs management of which factors contribute to these variances. For example, if the company is facing an adverse variance in the cost of goods sold, management can check whether the cost has risen due to higher material prices or production screw-ups, among other causes. This way, management can develop corrective actions to eliminate or reduce causes of variances and, in the process, get better results and financial position.

Key Performance Indicators [KPI] Tool

KPI are metrics used to assess a company’s financial, operational, customer, and employee productivity performance. They give management a comprehensive view of the organisation’s performance regarding its goals and objectives.

KPIs are used in management accounting to monitor and evaluate performance across many departments and business units.

Several typical financial KPI consist of:

Return on Investment [ROI]: The profitability of investments about their cost is measured by ROI.

Gross Profit Margin: The percentage of income that surpasses the cost of products sold is measured by the gross profit margin.

Cash Flow: Evaluate how much money the company can make from its activities.

Through consistent KPI monitoring, management may detect patterns, anticipate possible problems, and make data-driven choices to enhance performance and accomplish the organisation’s strategic objectives.

Balanced Scorecard Tool

The Balanced Scorecard is a strategic management tool that provides a comprehensive view of the organisation’s performance by measuring financial and non-financial metrics across four perspectives. The Balanced Scorecard is a strategic management tool that provides a comprehensive view of the organisation’s performance by measuring financial and non-financial metrics across four perspectives:

Financial Perspective: Reflects company’s financial performance in terms of profitability, revenue generation, and other critical investment ratios.

Customer Perspective: Responsible for monitoring customer satisfaction, customer loyalty and the market share of the organisation.

Internal Processes Perspective: Determines the productivity, quality, and creative performance of the organisation’s internal operations.

Learning and Growth Perspective: Measures employee training and organisation culture to ensure every employee gets the necessary training required for them to be productive in the organisation.

The features of the BSC are it provides indicators of business performance by aligning business activities with the strategic plan and view of the management. Through measurement at various organisational viewpoints, managers can make sure that they localise their decision-making and advance organisational utility.

Cost Volume Profit [CVP] Analysis Techniques

The link between expenses, sales volume, and profit can be understood using CVP analysis also called break even analysis. Using this method, management may ascertain the sales threshold at which the company will break even, reaching a point where total revenues and total costs are equal.

CVP analysis involves the following key components:

Fixed Costs: These include expenses like rent, salary, and insurance that don’t change based on the volume of production or sales.

Variable Costs: They are expenses like raw materials and direct labour that change proportionately to the volume of production or sales.

Sales Price: The cost at which goods or services are offered for purchase.

Contribution Margin: The amount available to pay fixed costs and make a profit, calculated as the difference between the sales price and variable costs.

Management can make well informed judgements regarding pricing strategies, production levels, and sales targets by determining the break-even point. In addition, CVP analysis aids in assessing the financial effects of adjustments to prices, sales volume, and costs, enabling management to plan and reduce risks.

Activity Based Costing [ABC] Techniques

ABC is a method that divides overhead expenses across goods and services according to the activities that produce them. In contrast to conventional costing techniques, which divide overhead expenses according to a single cost driver (such as direct employee hours) ABC understands that various goods and services use overhead resources in multiple ways.

ABC involves the following steps:

Identifying Activities: Management determines material handling, machine settings, quality checks, and other operations that result in overhead expenses.

Assigning Costs to Activities: Each activity is allocated overhead charges according to the resources used in that activity.

Assigning Costs to Products: The costs of each activity are then assigned to products or services based on their consumption of those activities.

ABC provides a more realistic view of the actual cost of producing a good or service, helping management make better decisions on pricing, product mix, and resource allocation. Management can find possibilities for process improvement and cost reduction by knowing what drives costs.

Standard Costing Techniques

Standard costing entails setting fixed prices for goods or services and contrasting them with actual costs to evaluate performance. These fixed expenses, sometimes standard costs, are defined by past performance, industry standards, and management projections.

Standard costing serves several purposes:

Budgeting: Financial targets and budgets are created using standard costs.

Performance Evaluation: The actual costs can be compared with the standard costs to determine the variances for operation and to evaluate them through standard costs.

Cost Control: Subsidiary costing assists the management to determine where costs are above normal and remedy the situation.

Standard costing is more applicable in manufacturing industries because it allows the management to assess the cost of production, control stocks, and analyse the effectiveness of the production line.

Scenario Planning Techniques

Scenario planning is a method for investigating many future possibilities and evaluating their possible effects on the organisation. This entails developing intricate scenarios predicated on various hypotheses including modifications to the regulatory landscape, market dynamics, and economic trends.

Management may better prepare for uncertainty by using scenario planning, which considers a variety of potential futures and creates solutions for each one.

By examining various outcomes, management can find possibilities, dangers, and backup plans to ensure the company is adaptable to change.

Conclusion

Management accounting is critical in supporting decision-making by providing pertinent and timely information, cost analysis, and performance evaluation.

Its tools and methods which include forecasting, variance analysis, budgeting, and scenario planning give managers the information and understanding they need to make choices that will propel their company forward.

Management accounting, highlighted in various free resources by The Knowledge Academy, offers the framework for choices that guarantee the long-term viability and expansion of the company, whether in budgetary planning, cost control, or future planning.